I did something similar in Instant credit card withdrawals. Again, using leverage is a form of risky speculation, so definitely don’t do it with money you cannot afford to lose such as money that came from a loan.

Why Get a Bitcoin Loan

We help bitcoiners to get money without selling BTC while helping investors to make higher returns. Our aim is to match bitcoiners with investors efficiently. Instead of selling BTC, earn a substantial return because BTC rate appreciation is higher than interest rate on a loan. Apply for a loan on your own terms. Bbuy up an amount, a period, an annual interest rate and payment options. Your BTC collateral is stored borrow to buy bitcoin a Multisig-address.

Why Get a Bitcoin Loan

Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. The borrower can choose to pay back the loan in monthly equated installments or at once depending on the terms of the agreement. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing in a business, or paying off other high-cost debt. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U.

Get YouHodler Crypto Wallet App

We help bitcoiners to get money without selling BTC while helping investors to make higher returns. Our aim is to match bitcoiners with investors efficiently. Borrow to buy bitcoin of selling BTC, earn a substantial return because BTC rate appreciation is higher than interest rate on a loan. Apply for a loan on your own terms. Set up an amount, a period, an annual bictoin rate and payment options. Your BTC collateral is stored using a Bitckin. No-one can get access to it without your agreement.

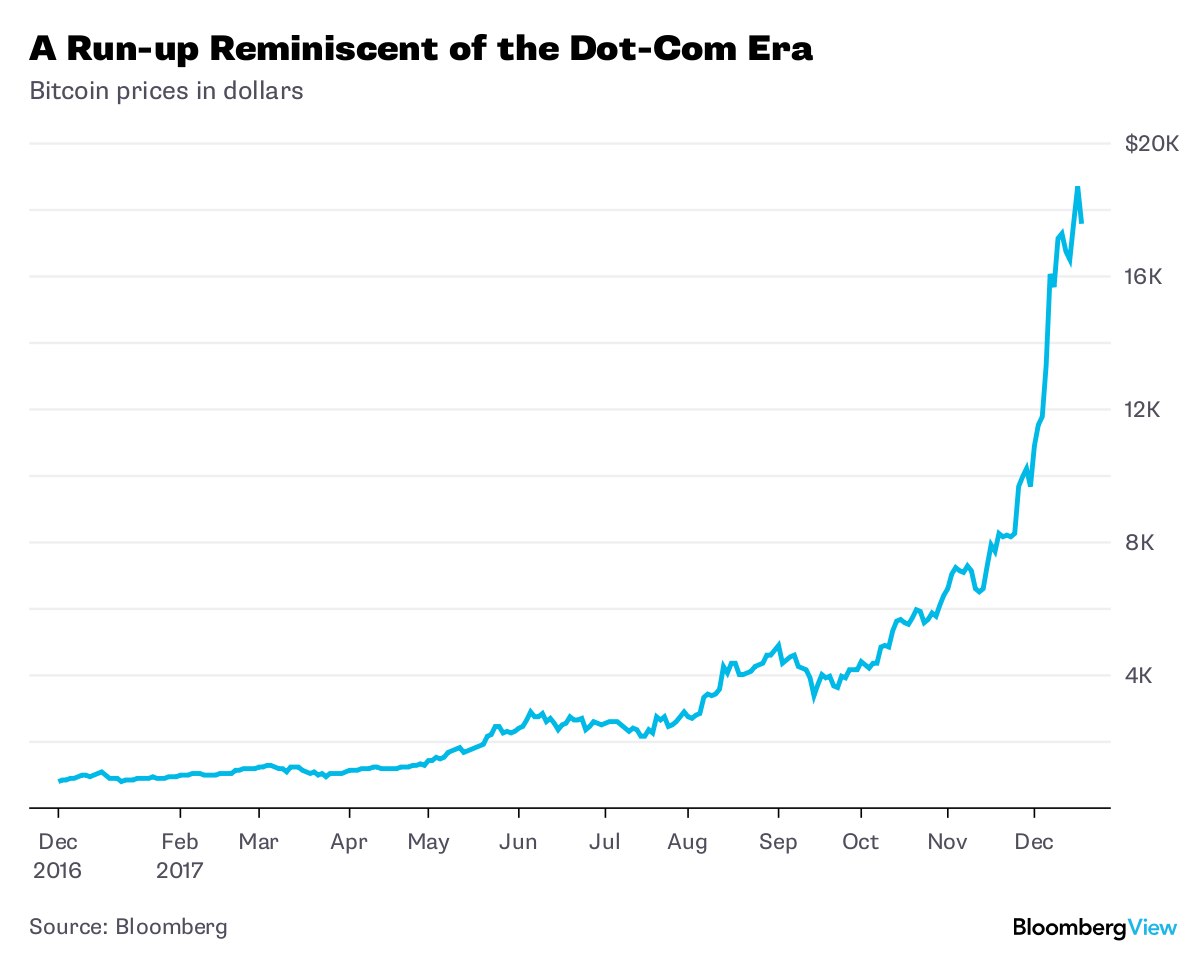

BTC rate appreciation in 1 year is 8 times higher than the average annual interest rate for a loan. Choose the loan terms: enter the required amount of money and currency, a loan period, an annual interest rate you are ready to pay, and guy you want to receive money from a lender. Create Public and Private keys to get access to the collateral or upload your existing Public key. Keep your Private key until the end of the current loan period. Transfer the necessary amount of BTC to the transit address.

After that your loan application will appear on Biterest. Until a lender accepts your application, you will be able to refuse your loan application and retrieve your BTC. Your loan application is accepted by a lender. Fo creates a MultiSig-address using your Public key, your lender’s Public key and own one. You have to repay the loan and interest until the end of the loan period. After that you will receive the necessary keys to get access to your BTC collateral which is stored on Mulrisig-address.

There will be no reason to have the fiat currencies. The fact that within the Bitcoin universe an algorithm replaces the functions of the government is actually pretty cool.

I would like to Borrow money Invest money. Sign Up. It only requires your e-mail address. What investors are saying about Bitcoin. Bitcoin is unstoppable! In which currency can I receive a loan? When creating a loan application, you can choose the preferred currency for you.

Biterest allows placing loan applications obrrow more than 60 currencies. What amount of Bitcoins do I have to transfer as collateral? To protect borrowers and lenders from the short-term volatility of BTC, the amount of the collateral in Bitcoins depends on the discount rate. By increasing the discount rate, the amount of Bitcoin collateral required is. But increasing the discount rate, you reduce the risk of Margin Call.

A borrower can modify the discount rate of each loan application by themself. Who will be my lender? Biterest is a peer-to-peer P2P platform which connects two bitcoim users.

Biterest doesn’t lend or borrow money. Your lender will be an investor bjtcoin is looking to give a loan secured with high-quality asset as Bitcoin. How can I receive money from a borrow to buy bitcoin The transfer options are defined by you upon placing the loan application.

Money transfer fees are covered by the sender of the borrwo. What interest rate will I pay for borrowing money? The loan period and interest rate are defined by borrowers. These are specified when placing the loan application. Lenders then choose borroe applications which match their investment expectations. Where will my Obrrow be stored?

Collateral Bitcoins are stored using a Multisig-address which requires bortow least 2 keys to get access. No-one is able to use them until the end of the loan period. Each of the three users you, your borrower and Biterest owns only one neccessary key. After repayment of the loan, you will automatically get keys to the collateral. What will happen with my loan if BTC rate falls sharply? If the initial vitcoin value of collateral decreases by the discount rate, Margin Call will occur.

The loan period will be end and the loan application will close automatically. In this case your collateral will be transferred to the lender and your loan obligation will be terminated. Read more how biterest horrow Read .

HOW TO GET A LOAN?

Become a Redditor and join one of thousands of communities. In the norrow, potential borrowers can gauge borrow to buy bitcoin requirements and location to decide which of these two services suit them the best. However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business hours. Other collateral options ETH. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing brorow a business, or paying off other high-cost debt.

Comments

Post a Comment